The smart Trick of Stonewell Bookkeeping That Nobody is Discussing

Wiki Article

Little Known Questions About Stonewell Bookkeeping.

Table of ContentsThe Main Principles Of Stonewell Bookkeeping Some Known Questions About Stonewell Bookkeeping.Stonewell Bookkeeping Things To Know Before You BuyThe Ultimate Guide To Stonewell BookkeepingSome Of Stonewell Bookkeeping

Rather of going through a filing cupboard of various records, invoices, and receipts, you can offer comprehensive documents to your accounting professional. After utilizing your audit to file your tax obligations, the Internal revenue service might pick to perform an audit.

That financing can come in the kind of proprietor's equity, grants, company loans, and financiers. Capitalists require to have an excellent concept of your service prior to investing. If you don't have accountancy documents, investors can not identify the success or failure of your business. They require up-to-date, precise information. And, that info requires to be conveniently easily accessible.

Stonewell Bookkeeping for Beginners

This is not planned as lawful suggestions; to find out more, please click here..

We addressed, "well, in order to know just how much you require to be paying, we require to understand just how much you're making. What are your profits like? What is your internet earnings? Are you in any financial debt?" There was a long time out. "Well, I have $179,000 in my account, so I guess my earnings (revenues much less expenses) is $18K".

Stonewell Bookkeeping - Questions

While maybe that they have $18K in the account (and also that may not hold navigate here true), your balance in the bank does not always determine your earnings. If a person got a give or a funding, those funds are not taken into consideration revenue. And they would certainly not work right into your income declaration in establishing your earnings.

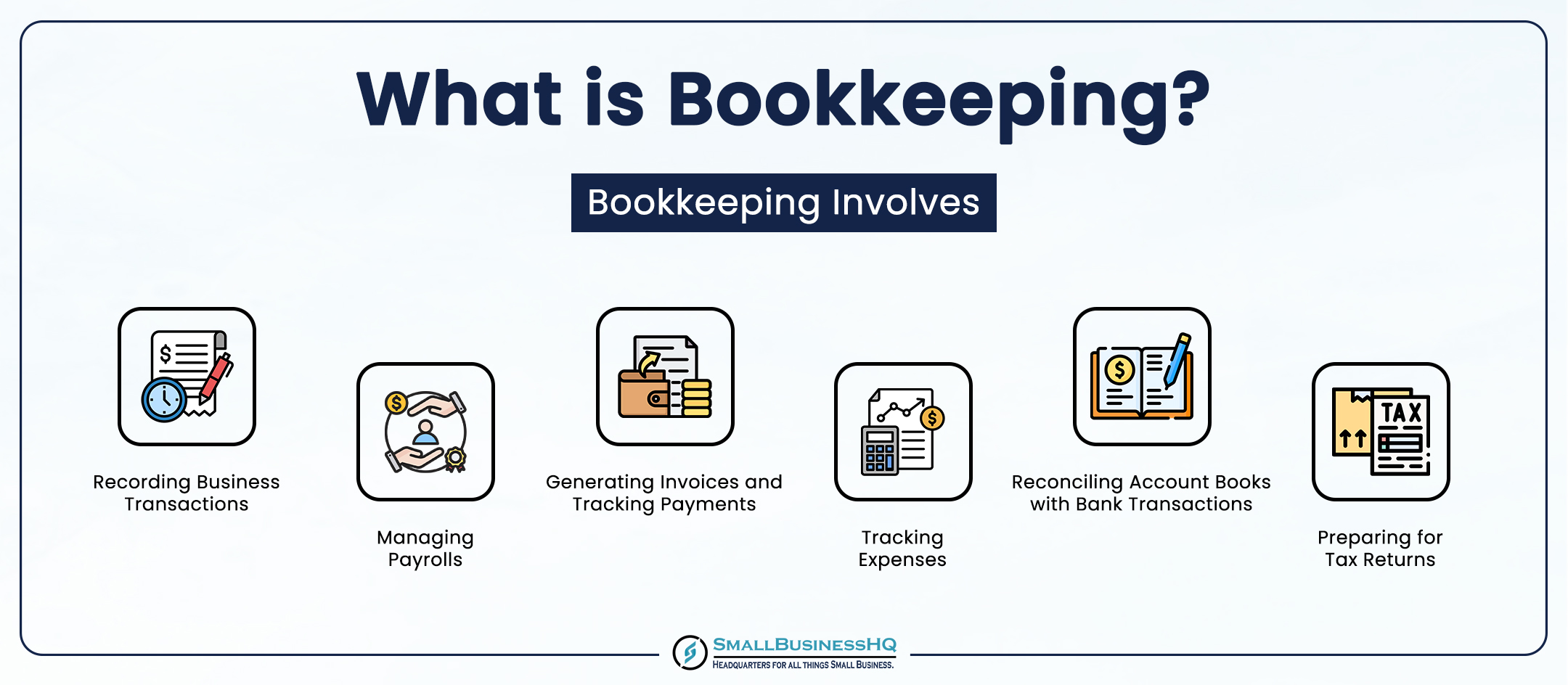

While maybe that they have $18K in the account (and also that may not hold navigate here true), your balance in the bank does not always determine your earnings. If a person got a give or a funding, those funds are not taken into consideration revenue. And they would certainly not work right into your income declaration in establishing your earnings.Several points that you think are costs and deductions are in reality neither. Accounting is the procedure of recording, identifying, and organizing a business's monetary purchases and tax filings.

A successful business requires aid from professionals. With reasonable goals and a qualified accountant, you can conveniently resolve challenges and keep those fears at bay. We devote our energy to ensuring you have a solid financial structure for growth.

The Only Guide to Stonewell Bookkeeping

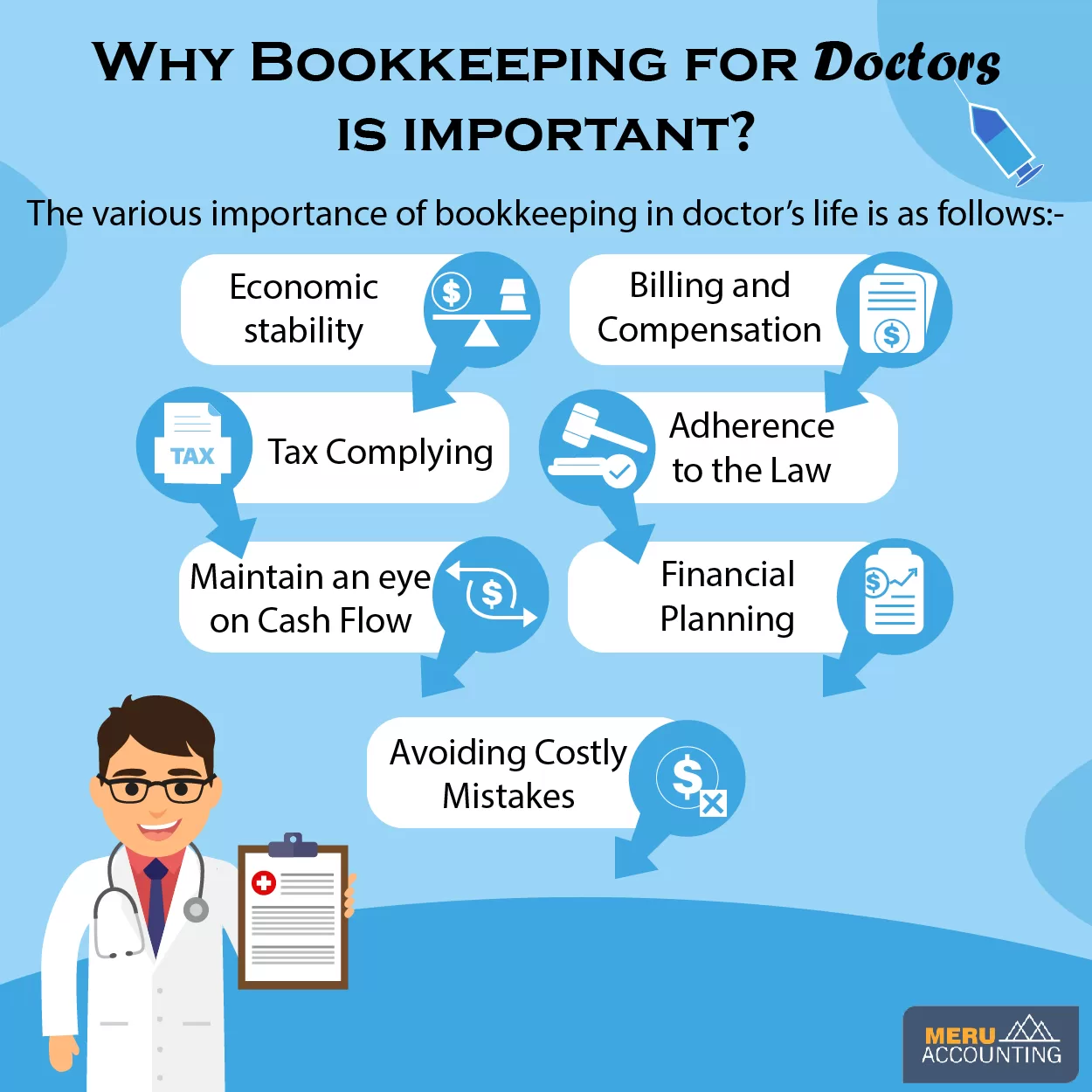

Precise bookkeeping is the backbone of good economic monitoring in any organization. It helps track income and expenditures, ensuring every purchase is videotaped effectively. With great bookkeeping, businesses can make much better decisions due to the fact that clear monetary documents supply beneficial information that can assist strategy and improve profits. This info is key for lasting preparation and forecasting.On the other hand, solid accounting makes it simpler to secure funding. Precise monetary declarations construct depend on with loan providers and financiers, increasing your possibilities of obtaining the capital you require to expand. To preserve strong economic health, organizations must on a regular basis reconcile their accounts. This implies matching purchases with financial institution statements to catch errors and stay clear of economic discrepancies.

A bookkeeper will cross bank declarations with inner documents at the very least once a month to find blunders or inconsistencies. Called bank reconciliation, this process guarantees that the monetary documents of the company match those of the bank.

They check current payroll information, deduct tax obligations, and number pay ranges. Bookkeepers produce basic financial records, consisting of: Earnings and Loss Declarations Shows revenue, costs, and web earnings. Equilibrium Sheets Details properties, obligations, and equity. Capital Statements Tracks money motion in and out of business (https://www.easel.ly/browserEasel/14618404). These reports assist company owner comprehend their economic placement and make notified choices.

Stonewell Bookkeeping Fundamentals Explained

While this is cost-efficient, it can be taxing and vulnerable to errors. Tools like copyright, Xero, and FreshBooks allow company proprietors to automate bookkeeping tasks. These programs aid with invoicing, bank settlement, and financial reporting.

Report this wiki page